Due to restrictions imposed by the Military Lending Act, Moneytree does not issue loans to covered borrowers, a term that includes active-duty military members, their spouses, and dependents. The difference, however, is that with a valid debit card, we receive your money the same day you pay. In addition, the creditworthiness check is not as difficult as there. Customers approved for a loan must have a valid debit card that can accept instant payments from us.

These answers will help you make a correct and immediate decision about the amount and duration of the cash advance.

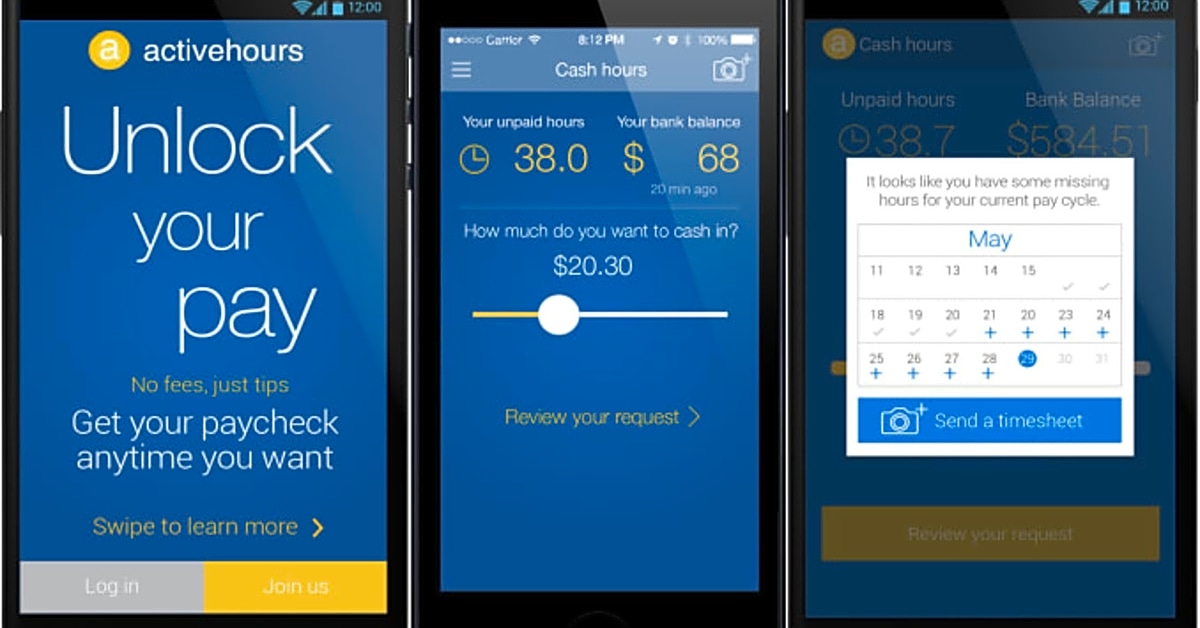

Can I have a loan sent to my debit card?

Be sure to include your debit card number when completing your online application to see if your card is eligible for instant financing. Borrowers may take out a second or third loan because they were unable to repay the first loan on time. Many see payday loans as a solid solution but face a huge hurdle as they don’t have a current account or savings account. As with any short-term loan, prepaid debit card loans are best used as a last resort. You can achieve interest rates that exceed the 700% annual interest rate.

Don’t forget that you can fill out the application online or search the web for cheap payday loan deals that make sense for you.

Can you have 2 payday loans in California?

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) have some overview of the payday loan industry, but have not yet implemented nationwide regulations. If you refinance a short-term loan with a second loan with the same lender, keep in mind that you will still have to pay the original amount with the interest rates and fees plus the additional cost of the new loan. DebtHammer provides content, calculators, advice, and paid programs for the 12 million Americans struggling with payday loan debt. Interest fees on a past due balance on California payday loans are capped at 15%, but upfront charges can be close to 500%.